State Farm is Testing a Blockchain Solution for Aspects of Auto Claims

State Farm has announced they are testing a blockchain solution for for different aspects of auto claims to see if blockchain technology can help improve some manual processes.

State Farm has announced they are testing a blockchain solution for for different aspects of auto claims to see if blockchain technology can help improve some manual processes.

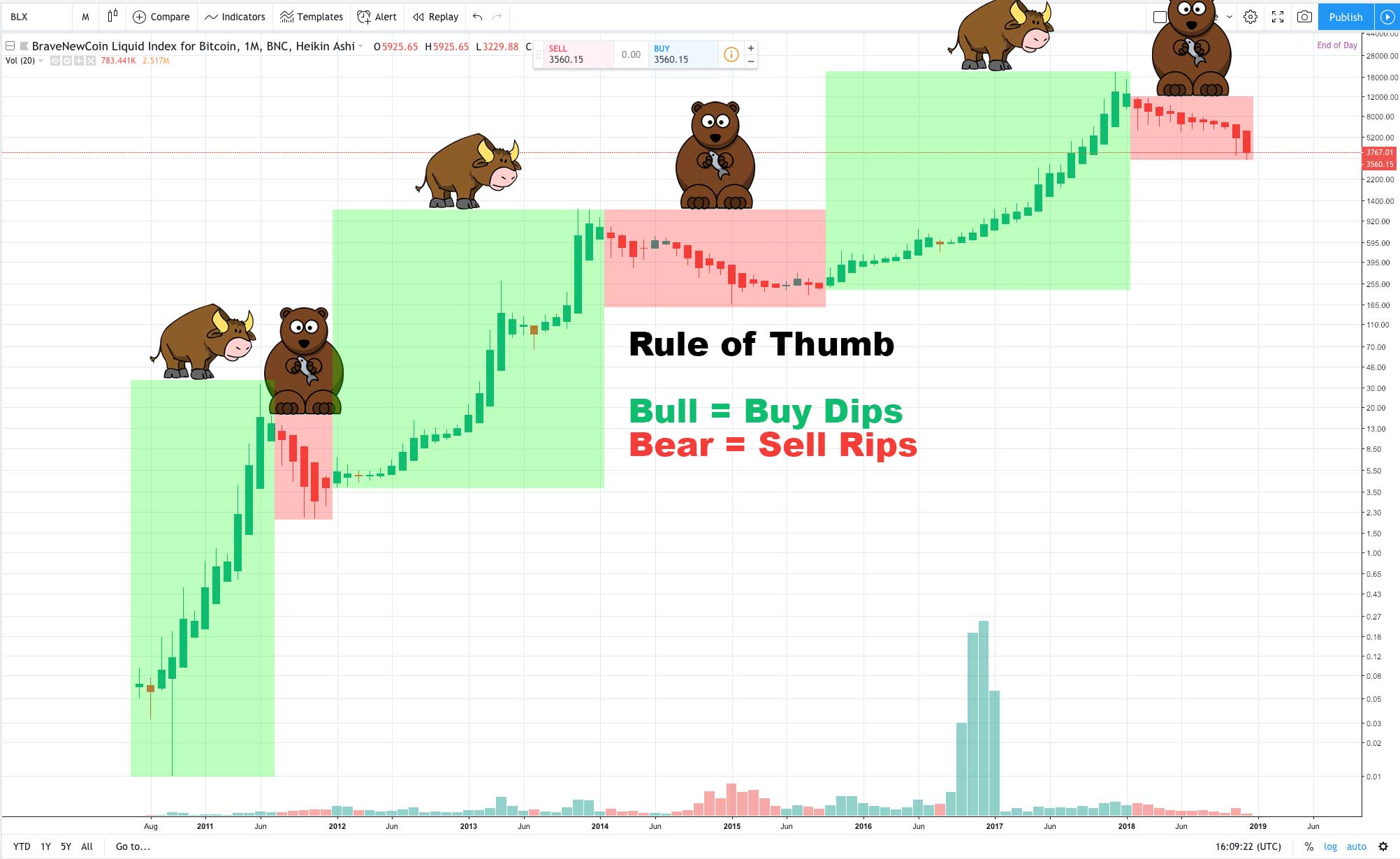

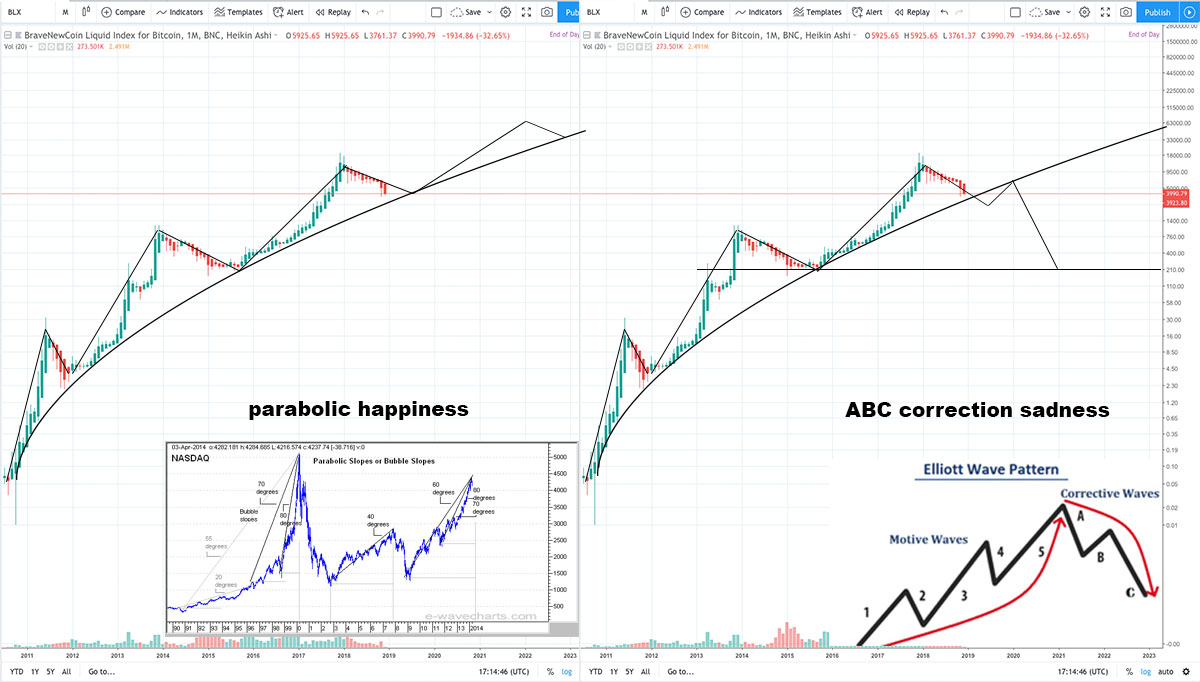

We have been in a bear market for Bitcoin for nearly all of 2018. For that not to be true it’ll take a serious change in price action.

Short interest on BTC and ETH hit an all time high today as prices dropped to 2018 lows. Short interest generally shows sentiment (bearish in this case), but it also can be a set up for a short squeeze (like in April).

Coinbase Pro will be adding the Ethereum-based tokens Civic (CVC), district0x (DNT), Loom Network (LOOM), and Decentraland (MANA).

Coinbase has reiterated its goal of adding a large range of digital assets, assuming they meet Coinbase standards and are compliant with local laws.

Ohio House Rep. Warren Davidson plans to introduce federal legislation to regulate ICOs. This includes creating an asset class for tokens that would prevent them from being classified as securities.

No one knows if Bitcoin will go back up or not. However, historically Bitcoin has been subject to a number of booms and busts and recovered to from new highs each time. The same is generally true for most altcoins that stood the test of time, although some never reclaimed their all time highs.

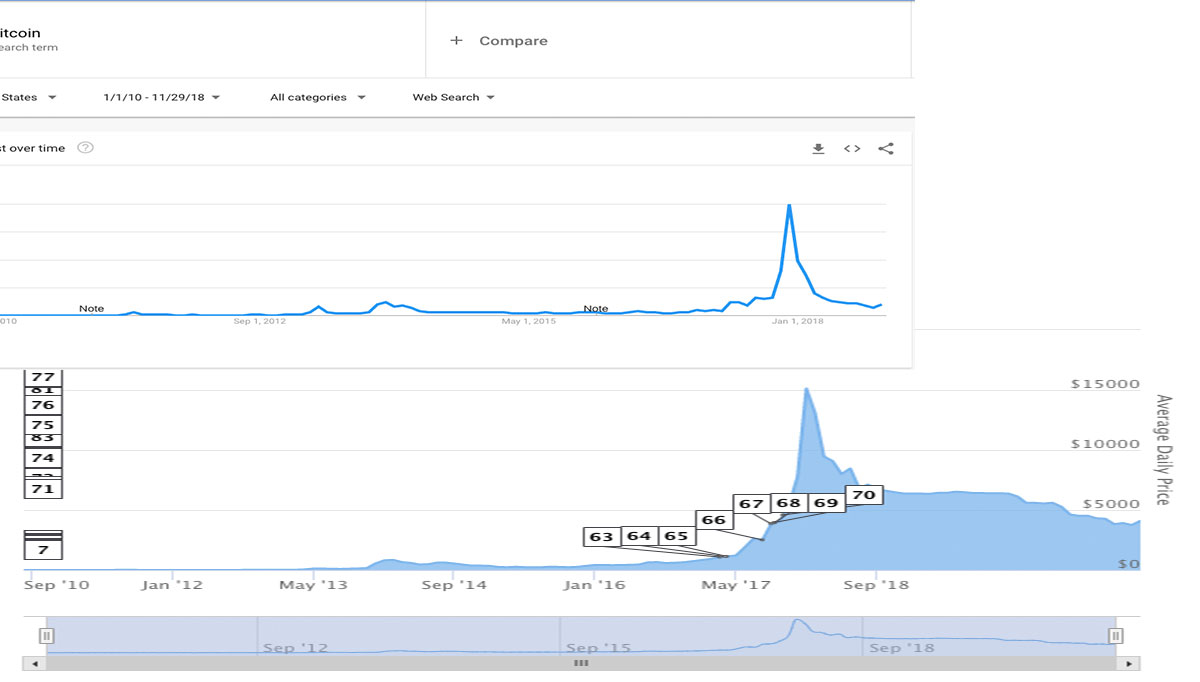

Bitcoin is finally trending up in Google Trends after being stuck at a low for most of 2018. In general the price of Bitcoin has directly correlated with Google trends.

Amazon announced at Amazon’s re:Invent conference that they are launching the Amazon Managed Blockchain platform. Users can build platforms using either IBM’s Hyperledger Fabric (available) or Ethereum (not available yet).

Chairman of the New York Stock Exchange NYSE Jeff Sprecher expressed the idea that “bitcoin and other digital assets are here to stay” at a recent CoinDesk Consensus: Invest conference.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.