A Look At Historic Crypto Crashes

A Look at Past Crypto Corrections and Past Crypto Crashes

TIP: I suggest clicking on the links I’ve collected below to get an idea of how similar past events are to events of today. Also, please see citations for a list of credits for the images and ideas I used on this page. Notably, the Bitcoin Crash and dotcom images are from Tommy Mustache’s Twitter and the corrections since 2010 image is from Charlie Bilello’s Twitter. Anyway, onto the article.

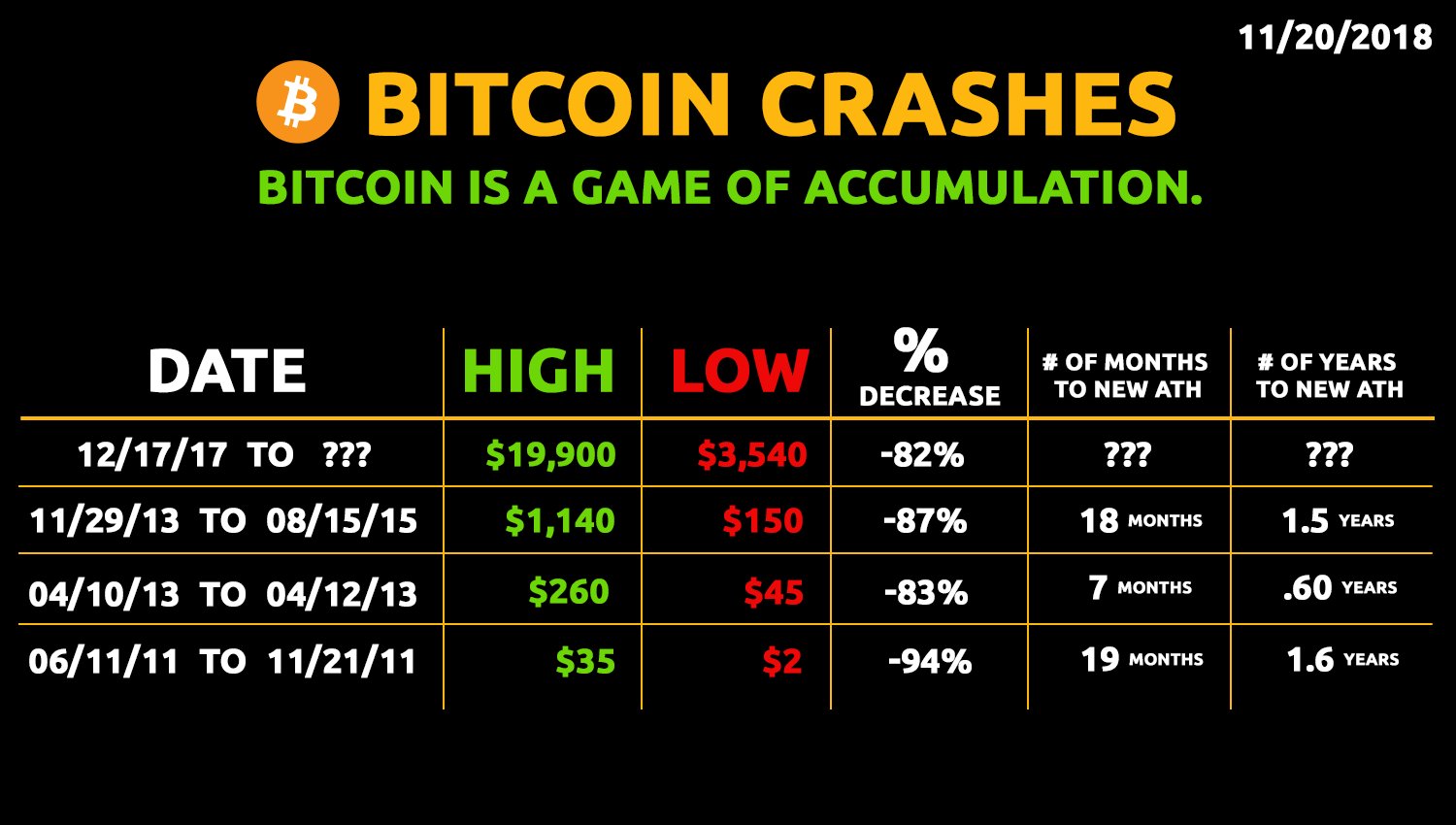

This isn’t the first major crypto bubble that started with a media blitz and ended with heavy losses for bag holders.[1]

This was true in the major crash of 2011, the major crashes of 2013 and 2014, and so it is again in the major crash of 2018. Further, this was somewhat true in other major corrections (see chart below).

Of those times, exactly zero have been fun for newcomers, bulls, and bag holders from what I can tell (I only experienced the end of the 2014 crash until now personally… but I’ve also done research).

Meanwhile, in each case the media took the time to remind us how bad it was (see this CNBC article from Jan 14 2015, AKA essentially the bottom).

In each instance Jamie Dimon gloated (guy has actually been FUDing Bitcoin for a while, look it up).

Each time there was talk about how the price was going under the price of mining. For example, see this BitcoinTalk.org thread from 2011 (TIP: the price continued to fall to under $2; the answer by the way is mining difficulty adjusts, some miners shut down, and the ones who stick around operate at a loss for a while):

At present difficulty levels, for me personally, anything below $8-$10/BTC is mostly a waste of time mining wise. The video cards are paid for, but at 0.50 BTC a day, I’m getting what, $60 a month so basically just covering electric. As the price continues to fall like the last month or two, at what point should we consider it “dead”?

Furthermore, and moving on with similarities, in each case an increasing number of bears learned to short and to doubt crypto as an asset (assuring the world it was a Ponzi).

Also, in each cycle there was FUD about hacks, ETFs, regulations, speeds and costs, and China.

It is literally like the same set of events, same concerns, and the same percentile drops have occurred to like odd, ironic, and painful clockwork.

Each time it seems like everyone who was going to buy already did and no new buyers will ever come in.

Each time “the mood on Bitcoin forums has turn[s] grim, with Bitcoin fans giving one another pep talks and debating how low the price can fall before the currency is declared dead.” – See: Bitcoin implodes, falls more than 90 percent … TIMOTHY B. LEE – 10/18/2011.

Bitcoin implodes, falls more than 90 percent from peak https://t.co/YpxyVOoN8u

— Erik Voorhees (@ErikVoorhees) November 25, 2018

Bitcoin corrections since 2010.

Or at least, I know the above historically from 1. research (thanks internet), and 2. maintaining this crypto site since 2015.

So while I can’t know the future, I can know history, and although no one knows how much worse it’ll get before it gets better (or if it’ll get better at all), what is happening on now is pretty on par with crypto history.

I think we can all understand that it does not feel good to HODL litecoin from $40 to $1.50 intellectually if we haven’t been there, and we can certainly understand that it does not feel good to HODL from $400 to $27 if we are there now.

Yet, those “lucky” old timers who have been HODLing all along… the ones people meme’d about at the top… well like, the road here was paved in losses this great or worse.

Either you buckle up and go for the ride, or you don’t.

In 2011 when Bitcoin “imploded,” my research shows me that everyone thought it was dead. I mean, you have this media blitz, it flies up to $30, and it falls all the way down to less than $3 and suddenly the media is being all dark…?

You feel like a fool for buying at $30 by the time the full 90% correction has set in and you are still HODLing. ?

You probably sell the second $30 hits again if you haven’t already taken a loss. ?

And so it was with Amazon in the tech bubble, right? Like you feel like a champion for selling for $10 after buying at $100, because it goes to $5. And you feel like you dodged a bullet selling at $100 on the way back up… but in reality, any price between $5 and $100 was great in retrospect.

2001 dotcom crash

All the above said, some cryptos died in past cycles and some tech companies did too in the tech crash. And again we don’t know the future… So its not like you can just go all in PetsDotComToken and expect future lambos…

But, history tells us that those who don’t give up when the going gets rough, are the ones who do well next cycle. So many sort of assumed they would get rich from buying crypto at the top or fell in love with the tech and went in at any price, no different than in past cycles or in the dotcom crash. The reality is though, the tech is better than it was a year ago and the time to buy with hopes of future lambos is closer to where we are now then where we are a year ago (that is basic logic; please don’t buy crypto in hopes of future lambo; results may vary; consult a fiduciary before taking Bitcoin; if you experience bleeding, that is normal).

Bottomline: What seems like epic pain at the time has so far ended up looking like the chart below over the long haul. That chart is full of Brian Kelly’s hopes and Jamie Dimon’s FUD, it is full of ETF hopes and and 80%+ crashes, but notably… it is an uptrend. Let’s hope that uptrend holds (even if that means going down some hard to swallow percentage points first).

Bitcoin is essentially a bullish log fractal, 2010 – 2018… you know, so far.

- Bitcoin Crashes Image in Header. Tommy Mustache on Twitter