Bitcoin Halving is Less Than a Month Away

The Bitcoin halving is less than a month away. The price of BTC is still down more than 50% from the all-time-high, and the question on everyone’s minds is will the halving impact price.

The Bitcoin halving is less than a month away. The price of BTC is still down more than 50% from the all-time-high, and the question on everyone’s minds is will the halving impact price.

Bitcoin is potentially breaking out toward the upside from a range formed in March 2020. The next major resistance is the previous range above that was formed in early March as shown on the chart.

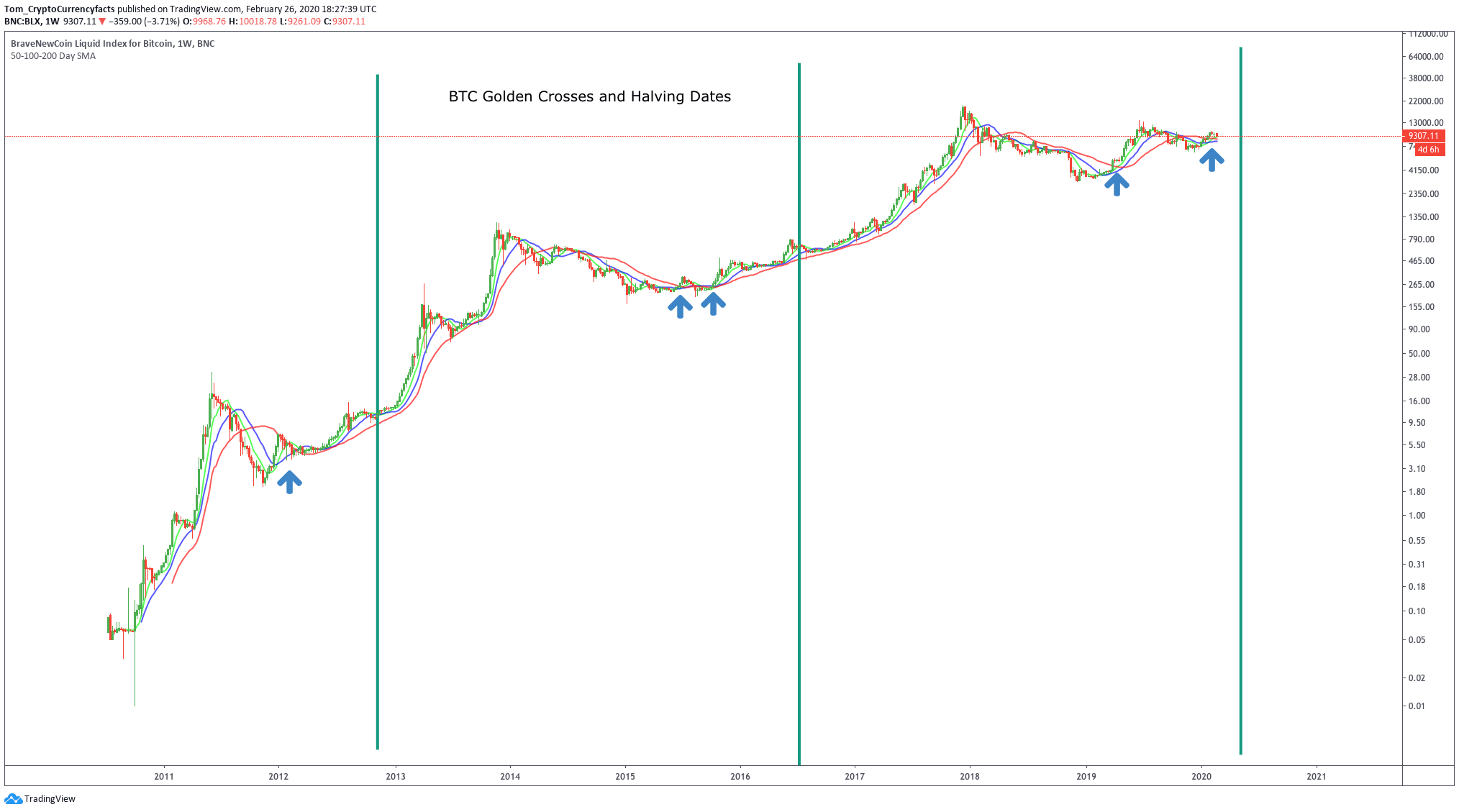

Bitcoin is about to experience its third halving. The first halving was Nov 28, 2012, the second July 9, 2016, and third is mid-May 2020. This chart shows repeating trends going into the halving.

Binance will delist all FTX leveraged tokens on March 31st. The official reasoning is that users were misunderstanding the way the tokens devalued over time as the underlying assets fluctuate back and forth.

The coronavirus stimulus bill may include digital dollars that are stored in digital wallets as part of the relief.

Bitcoin couldn’t avoid the coronavirus panic, crashing by a full 50% on March 12th. However, Bitcoin has since been recovering and might just start being attractive with central banks printing money.

Most markets are in a panic over coronavirus. Bitcoin finally took a big hit along with broader markets on March 12, 2020, dropping over 50% from around a $7,960 high to a low of $3,800.

The Coronavirus has been taking out just about every market, and crypto has been no different. However, Corona hasn’t been enough to throw Bitcoin off any long term trends.

India’s Supreme Court overturned their central bank’s ban on cryptocurrency trading, lifting the ban that had been in effect since April 2018.

After an epic run crypto is seeing a correction that seems to be correlating with Coronavirus fears in other markets.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.