Bitwise Report Shows the True Nature of the Crypto Market

Bitwise has come out with an amazingly telling report on the true nature of the crypto markets in terms of volume.

Bitwise has come out with an amazingly telling report on the true nature of the crypto markets in terms of volume.

This chart looks at BTC from 2013 – 2019 and beyond using fib levels. You can see the 2013 market cycle looks a lot like the 2017. Does that pattern repeat?

ADA is setup for a breakout with it forming a potential inverted head and shoulders bottom right below the 200 day ema.

The second BTT airdrop for TRX holders occurred on March 11th. It is notably about 1/10th the size of the first airdrop.

Kin is moving from its current Ethereum-based blockchain, to a new “Kin Blockchain.” You must swap your tokens by June 12th. Here is how you do it.

Tether used to say they were backed 1:1 by USD. They now say “Every tether is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities (collectively, “reserves”). Every tether is also 1-to-1 pegged to the dollar, so 1 USD₮ is always valued by Tether at 1 USD.”

XLM is now on Coinbase and Coinbase Pro. That means buying and selling XLM is as easy as opening up the Coinbase app and hitting the buy or sell button.

Maker (MKR) and its stable coin DAI have been in the works since 2015, but they have really shinned during the 2018 bear market. MKR and DAI have been added to Coinbase, and MKR is now a top coin by market cap in 2019.

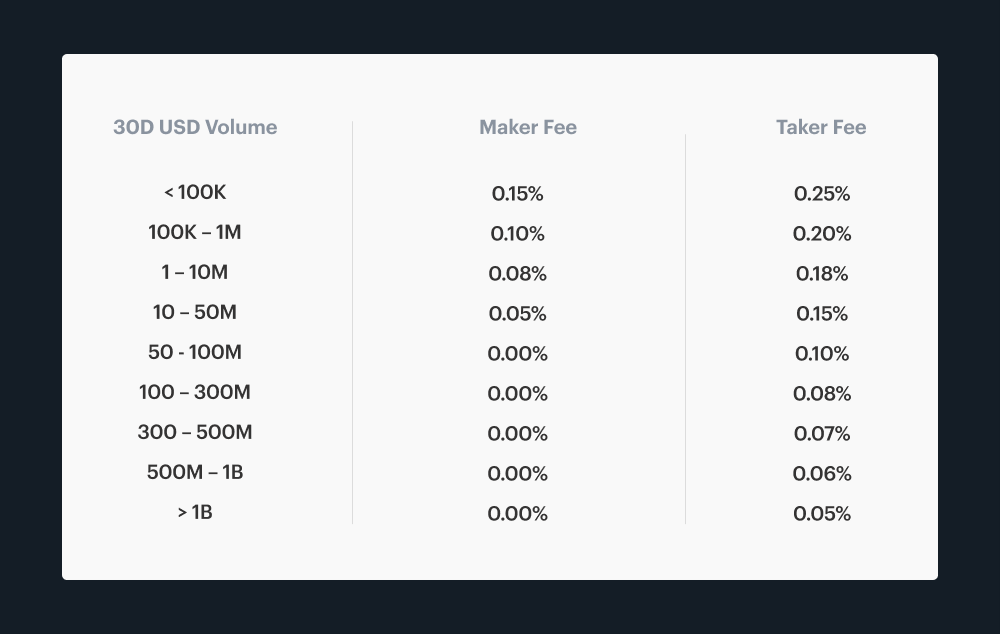

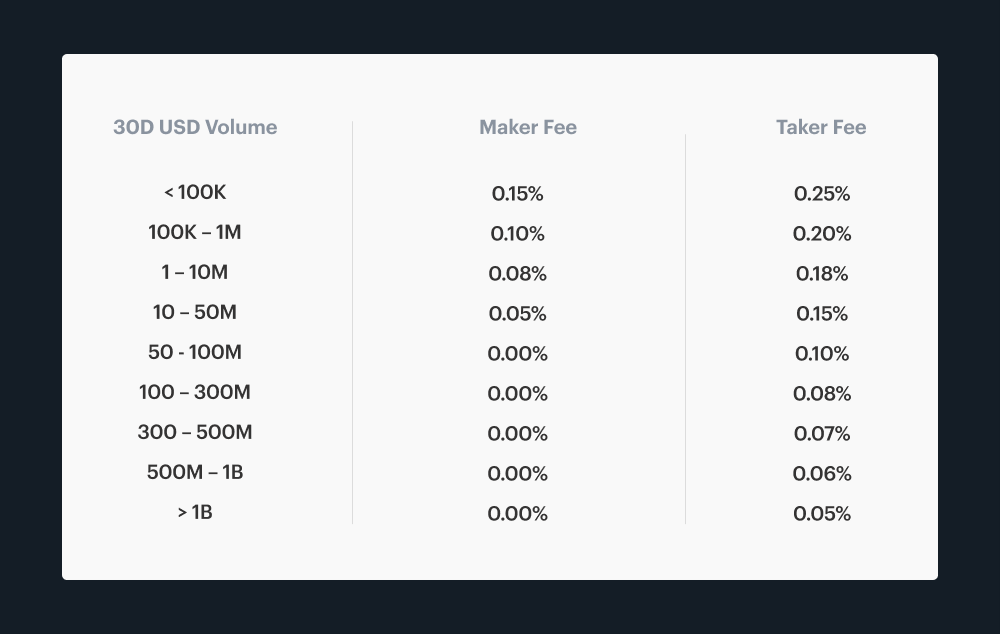

Coinbase Pro will introduce a new fee schedule that does away with free limit orders starting March 22nd. This is part of a range of changes they are making to their market structure.

Coinbase Pro will introduce a new fee schedule that does away with free limit orders starting March 22nd. This is part of a range of changes they are making to their market structure.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.