The Manic Depressive Nature of Crypto

As more people enter the crypto space, large investors, institutions, states, etc, they seem to be adopting a tone that mirrors the manic depressive nature of crypto.

Cryptocurrency opinions, op-eds, speculation, and insights. Oh, my!

As more people enter the crypto space, large investors, institutions, states, etc, they seem to be adopting a tone that mirrors the manic depressive nature of crypto.

Will Bitcoin go to $10k this weekend? I muse on the possibility of saying hello to our old friend Mr. Ten Thousand Dollars.

One of the simplest ways to gauge the medium term price trends of the crypto market are the 12 and 26 EMAs on Bitcoin on daily candles (the only indicators on GDAX).

Coinbase’s CEO Brian Armstrong wrote an article about the current state and future of cryptocurrency. I’d like to address one point he made, the concept of an investment phase and utility phase in cryptocurrency.

Some people think Bitcoin is worth $20, others think it is worth over $200k. Can we come up with a fair price that isn’t based on sentiment or logarithmic charts? I think we can.

Here is a top ten list of the best and worst things about cryptocurrency. The idea of this list is to express what I consider to be some amazing benefits and glaring sticking points.

There is a theory that the Bitcoin market is being manipulated by investors who hold futures contracts. The idea being that this explains the price action of 2018. I discuss that theory and offer opinions on it.

Bitcoin and altcoins have been on what increasingly feels like an epic bull run after months of correction. This set of events can teach us about the nature of cryptocurrency culture and markets.

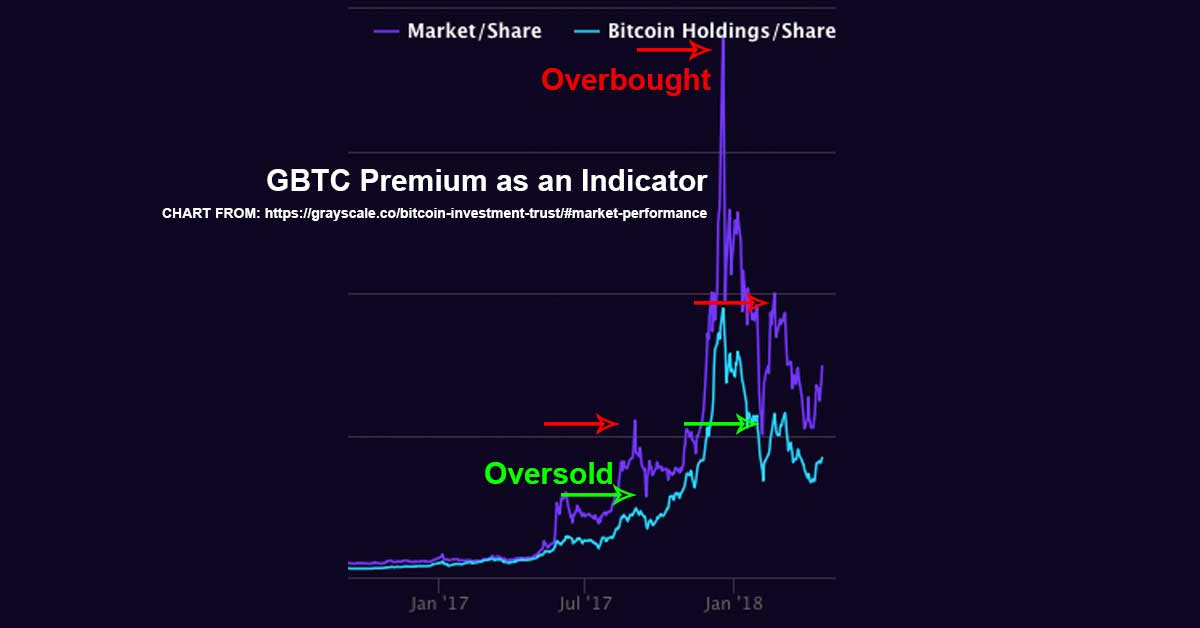

In some markets, people will pay a premium for Bitcoin products when crypto is doing well. Specifically, this can be seen in South Korean markets and in GBTC.

Thomas Lee of Fundstrat had a spot on prediction about Bitcoin, predicting it would go up as tax season ended (it did). His other predictions include $25k Bitcoin in 2018 and $91k by 2020.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.