Is Cryptocurrency a Good Investment?

The Pros and Cons of Investing in Cryptocurrencies like Bitcoin, Litecoin, Ethereum, and other Alt Coins.

Investing in cryptocurrencies like Bitcoin, Litecoin, and Ethereum is a risky investment. We cover the pros and cons of investing in cryptocurrency.[1][2]

Should I Invest in Cryptocurrency?

Investing in cryptocurrency could be a good investment, or it could not. That is true for cryptocurrency in general and likely for you as a person as well.

With cryptocurrency being young, and the market being historically volatile, there is no ‘yes or no’ answer about the wisdom of investing in cryptocurrency. It is with this in mind that we cover some pros and cons and friendly (but not professional) advice.

How to invest in cryptocurrency: If you want to invest in cryptocurrency, you have a few options. New investors can choose between the GBTC trust sold on the stock market, a cryptocurrency IRA (we don’t want to recommend one until we have reviewed them), a user-friendly solution like Cash App or Robinhood, or an exchange-broker-wallet hybrid like Coinbase/Coinbase Pro which allows customers to buy/sell/store a range of cryptocurrencies. Each option has its pros and cons, but notably, only an exchange-broker like Coinbase/Coinbase Pro allows one to trade and invest directly in cryptocurrency. Learn more about how to invest in cryptocurrency.

General advice: With the above said, please note that we don’t offer professional legal, investment, or tax advice on this site. With that in mind, the best advice is to be prepared to lose every penny you invest in cryptocurrency, it probably won’t happen, but it could, and you need to go into the cryptocurrency with some stored up resilience. If, with that warning, you want to ease into cryptocurrency investing. Consider taking no more than 1% of your investable funds, and then get a toe wet with GBTC or Coinbase. Keep it simple to start, and then consider easing into other options like online cryptocurrency exchanges or even cryptocurrency mining. Also, consider dollar-cost averaging (taking your funds for the year and buying weekly or monthly on lows). This will help you buy the average price of an otherwise volatile market. Sure, you can jump right in, but if you time the market wrong, you could be in for an unnecessarily tense roller coaster ride.

TIP: The least risky coins are usually the coins that have been around the longest and have the highest market cap and highest volume. See a list of cryptocurrencies. Anything other than Bitcoin, Litecoin, or Ethereum is riskier than those three. Of those, Bitcoin is the current top coin for longevity, market cap, and volume. It is notably also the most expensive.

The Pros and Cons of Investing in Cryptocurrency

There are several pros and cons to consider before investing in cryptocurrency. Some of the most important features of cryptocurrency investing can be summarized as follows:

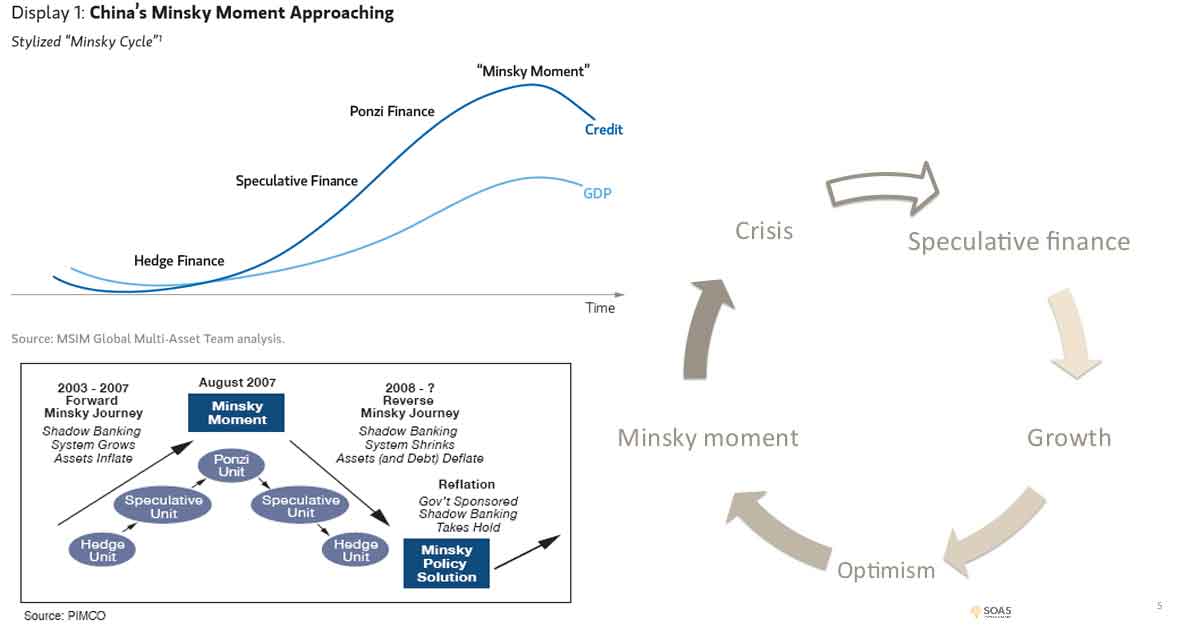

CON: The cryptocurrency market has been very volatile since its inception. The price of Bitcoin can swing up or down hundreds of dollars in a day, and the price more than quadrupled in 2017. We have already seen one bubble and bust back in 2013, and currently in 2017 bitcoin looks like it is in a classical bubble. In fact, our header image is a reference to the psychology of bubbles. Specifically, it is a reference to “the Minsky cycle,” which may give you an idea of how likely it is that we are in bubble territory. That said, there are many more factors to consider here. If there weren’t, the answer to investing in cryptocurrency would have just been a simple “no.”

PRO: There is a significant upside to investing in cryptocurrency. That is, the cryptocurrency market is still young, and the most optimistic of investors are projecting future prices that would make buying any of the major cryptocurrencies (even at the height of 2017) a good bet. If Bitcoin goes to $6k, $7k, $15k, or say $600K+ like some notable investors suggest, $4.2K (about what it trades here in the second week of September 2017) is going to end up looking like a great price, regardless of what happens in the interim.

CON: Even if cryptocurrency is a good long-term bet, we don’t know if Bitcoin (or any of the top coins) will be the one that sticks around. This is even more true for the countless less popular coins with smaller market caps. Thus, there is a risk in betting on a given coin even if cryptocurrency is here to stay and the best prices are ahead.

PRO: Even if cryptocurrency is in a bubble, the trend could very well be toward cryptocurrency being an important medium of exchange and store of value in the future. If the current price is lower than the highest price we will ever see. That makes it a good long-term bet. Meanwhile, for day traders, cryptocurrency is a very risky (but potentially rewarding bet).

CON: Those with low risk tolerance have an added difficulty; they are prone to getting weak knees and pulling out at a loss while the market is correcting or slumping. If you bought Microsoft at the height of the .com bubble, it seemed like the end of the world unless you waited 17 years. 17 years later you realized your profit and a nice profit at that. Microsoft was never a bad bet; it only looked like one after the bubble popped to those who bought at the height of the bubble. If Bitcoin behaves like the Microsoft of cryptocurrency, then an investor needs to be prepared to take a loss or sit on a loss for a while if the market goes down (if this is a major bubble). That takes a certain type of steady mindset and expendable funds. In other words, there are psychological factors to consider along with economic ones.

CON: Regulators of major countries like the U.S., Russia, and China can have big impacts on cryptocurrency (they likely can’t crush it, but they can make life difficult for investors). The U.S. shutting down the Silk Road caused a crash in 2013 (popping a bubble that didn’t recover until 2017). In 2017 China began talking about banning ICOs (crowdfunding for new coins) and gave signals of disapproval (bringing the price of a Bitcoin from $5k to $4k in a matter of hours). Currently, cryptocurrency trading is legal in the U.S., Russia, and China (although that could change), and the U.S. and Russia have been fairly friendly toward cryptocurrency but keep in mind governments can influence the price (even when all other signals are good).

PRO: Since the market is volatile, if you time your buys and sells correctly, you can often buy high low and sell high. There is money to be made.

CON: The only way to trade cryptocurrency on the stock market is to buy GBTC, which trades at a premium. The simplest way to buy cryptocurrency for a novice aside the stock market is via a company like Coinbase, and they charge a premium for that (much lower than GBTC’s, but still a premium). Meanwhile, the lowest fees are on the open exchanges of the internet. Where their fees are low, their risk and complexity are higher than GBTC or Coinbase. Between premiums and fees and finding a seller, all options for trading have costs that eat into any potential gains. Those can be hard to calculate.

PRO/CON: In the U.S. cryptocurrency is legal, regulated, and when held for investment taxed as an investment property. This is good. It means you can keep a tally of your trades, treat them as capital gains, and then report to the IRS just as with any capital investment. On the other hand, the exact rules are murky, and this complicates things. For example, it isn’t 100% clear that the rules of like-kind property exchange apply to cryptocurrency. Assuming they do apply, that means every trade from one cryptocurrency to another is a taxable event for the year. Meanwhile, if they don’t apply, then you don’t pay taxes on cryptocurrency until you take it out of cryptocurrency and convert it to USD (or otherwise spend the coin). This is far from the only tax consideration. Thus, one should study and consider the tax implications of cryptocurrency before making investments in the cryptocurrency space. That means you may need to hire an accountant, and that cost must be considered.

PRO/CON: In 2017 we saw a boom of new coins and ICOs. That could be good for the market, but it could also flood the market with low-quality coins and result in bad experiences for new investors. It could also draw too much heat from regulators. Cryptocurrency is exciting and legal here now, but too much chaos from an oversaturated market full of low-quality products could put a damper on that.

PRO: Cryptocurrency is, despite all its risks, perhaps the most exciting asset of the 21st century. A decentralized digital currency that works on the very interesting and likely here-to-stay blockchain technology. There are a thousand reasons to be excited about cryptocurrency, but also reasons to be conservative in your investment strategy. Don’t dump your whole 401k into cryptocurrency, but don’t be scared to get a toe wet with a small investment you are comfortable losing (to join in the fun and to learn more now, so you have the know-how later).

CON: The attitude of crypto investors seems to change with the wind. A bit of bad news in terms of regulations tends to send prices into a tailspin one day, but the same news another day might have no effect. Join a given cryptocurrency group on social media, and you’ll note it goes from hot-to-cold with the weather. The market is somewhat “finicky.”

TIP: If we are in a bubble, and if that bubble pops, then after that cryptocurrency (specifically the major ones still standing) becomes a bet worth considering. The only reason for taking extreme caution is the current potentially high price. If the price goes back down to 2015 levels, then the number of pros will increase. Likewise, if government favors cryptocurrency over the next year, it will help add more pros to the list. The unknowns and high price and volatile market make it risky, but there are plenty of reasons to be excited despite all that especially long-term.