The Kimchi and GBTC Premiums are Good Indicators of Crypto Sentiment

Opinions on Using Crypto Premiums as Indicators of Crypto Sentiment

In some markets, people will pay a premium for Bitcoin products when crypto is doing well. Specifically, this can be seen in South Korean markets and in GBTC. However, there are other examples, such as countries where the national currency is experiencing inflation. This makes these premiums useful indicators of price direction and sentiment in some respects (in my personal opinion at least).

I explain the two important ones for me, the Kimchi and especially the GBTC premiums, here.

In short, that page says:

- The Native Asset Value (NAV) to Premium Divergence (premium is increasing) = Bullish / Becoming Overbought

- Nav to Premium Convergence (premium is decreasing) = Bearish / Becoming Oversold

With the above noted, all I want to do on this page is point out that these premiums work well as an indicator of crypto sentiment and to some extent price direction.

When the premiums are low, crypto sentiment is generally poor. Crypto sentiment is generally poor because prices are going down. When premiums are high, crypto sentiment is generally very favorable. Sentiment is generally favorable because of the belief that “we are going to the moon.”

TIP: ETCG (the Ethereum Classic Trust) premium and the ETHE (the Ethereum Trust) premium are a good indicators too! These came out after I wrote this article, but the logic is the same. Also, stocks associated with cryptos (like blockchain stocks, chip stocks, etc) can double as indicators as well. If there is a high premium, sentiment is probably bullish… but the trust is arguably becoming “overbought.”

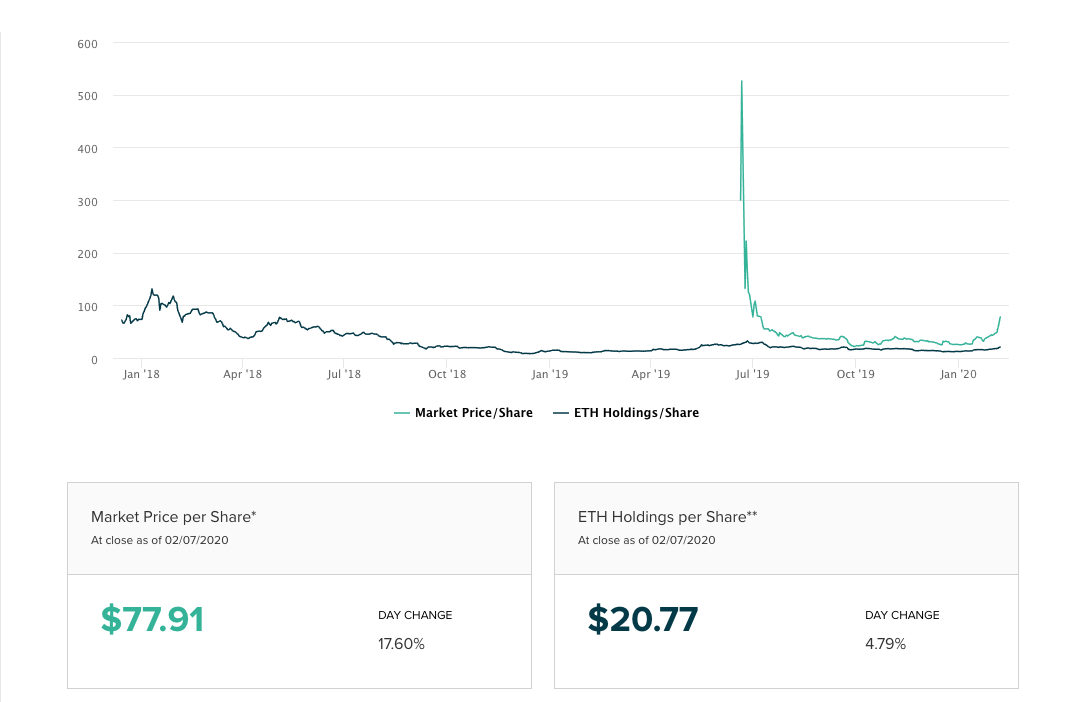

TIP: If a new trust just comes out, it may start its public trading life at a very high premium. This isn’t a sentiment indicator, this is just a type of price discovery the average person likely wants no part of. See the ETHE chart below to get a sense of what I mean. ETHE starts out with a high premium in 2019 upon launch that is not an indicator of sentiment, it is just overpriced ETHE finding a fair price according to the market. However, the price action finally resolves into a premium that is an indicator of sentiment in 2020.

The ETHE Premium. Like the GBTC premium, the ETHE premium can be seen as an indicator of crypto sentiment.

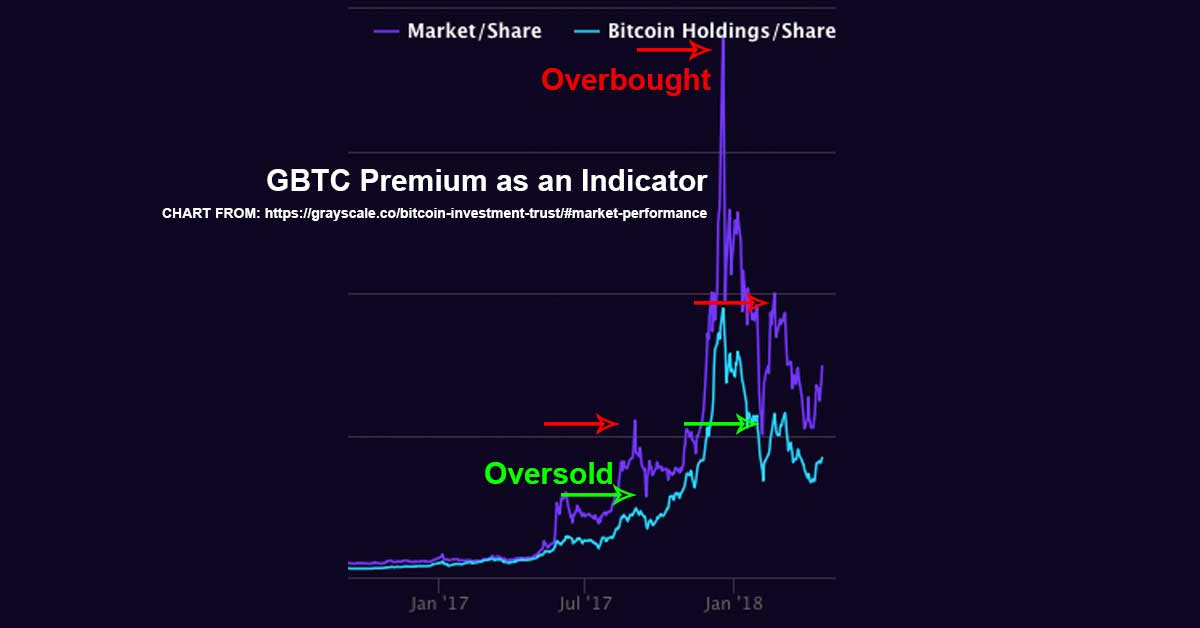

TIP: See the current premium of GBTC here: the historic GBTC premium at Greyscale.co (one might say in respect to this, “if the purple and blue lines are diverging it is bullish for Bitcoin, if they are converging it is bearish… but like RSI too much movement in one direction can indicate Bitcoin being overbought or oversold”). Check out the chart below for another look at this.

When sentiment is poor, crypto tends to be a better buy, when sentiment is favorable, it historically has been a good time to take profits. The logic here being that crypto is volatile, and although we make trips to the moon, we historically return to earth to fuel up rather quickly.

That may seem backwards, to buy when sentiment is poor and to sell when everyone is bullish. Then again, it may seem odd to pay 50% more for a Bitcoin than market value. The crypto world is full of oddities… but it is also full of patterns. Here this less about passing judgments and more about pattern recognition!

The reality is, at the height of Bitcoin mania over 100% premium might be paid for shares of the Bitcoin Investment Trust (historically this has been the case). Meanwhile, at a low point, we can see premiums reduced to as little as 30% or lower.

I see this indicator as bit like a mash-up of RSI and MACD, when the premium is trending up, we generally find crypto prices trending up. When it is trending down, we generally find crypto prices trending down. The premium essentially never goes to zero, so the closer it gets, the more likely it is that crypto is oversold… the closer to 100% it gets, the more likely it is that crypto is overbought.

One would think this would just work for Bitcoin alone, and that is somewhat the case. However, since Bitcoin and crypto are so closely related, and since we have other premiums like the Kimchi premium to look at (which appears on most if not all cryptos), we can really use this trick to get a sense of the sentiment and to some extent price direction of the market as a whole.

In simple terms, when those with reduced access to crypto are willing to pay more than its current market value when crypto is going up, because they believe it will go up further, and that tells us that this will in turn likely push prices up further in the short term.

Meanwhile, historically crypto never just keeps going up, rising prices and premiums only continues for so long before the inevitable correction happens and the indicators reverse (again, a lot like RSI).

With all that covered, don’t mistake this as a reason to avoid South Korean exchanges (if that is an option) or GBTC (if that is an option).

On a good day, South Koreans and GBTC investors actually see bigger gains than the rest of us. Not only is their asset inflating like ours (“ours” if you aren’t in this group), but the premium on their asset is inflating as well!

Of course, these investors also have to be careful in corrections, as when it goes the other way, they have more room to lose money for the same essential reason (they lose both the underlying value and the premium).

This is an odd situation, but this pattern has been very consistent over time. It is likely it won’t change until South Korea sees more tradable supply (most supply is sat on by large investors) or until more crypto options are available for exchange on the public stock market (which would mean more supply and likely less of a premium on GBTC).

Until something fundamentally changes, we have ourselves some rather useful indicators and specific investors have some unique opportunities.

NOTE: One big takeaway here is that demand for crypto may actually be greater than we see on the exchanges. The exchanges have a big barriers to entry. We can see in GBTC that there is a lot of demand from people want to access crypto through traditional means like via their 401ks and IRAs.

TIP: Sometimes GBTC specifically tends to stall out when Bitcoin goes up or down. One can think of this as its price and premium catching up with each other. This can at times make GBTC a lackluster investment. In times when it is stalling, it likely means sentiment isn’t fully in one direction or the other. Consider, prices can move in the crypto market due to factors other than sentiment (for example a big player like a hedge fund could be buying up or selling off coins).

TIP: An indicator is one single tool in a tool belt. All tools in an analyst’s tool belt speak to probabilities, not certainties. Further, this trend is something I noticed as a researcher who writes about crypto, not as an analyst. Do your own research and make your own investment choices.