How to Trade Cryptocurrency – For Beginners

A Beginners Guide Trading Cryptocurrency

Everything You Need to Know to Start Trading Cryptocurrencies Like Bitcoin and Ethereum

We explain how to trade cryptocurrency for beginners. To start trading cryptocurrency you need to choose a cryptocurrency wallet and an exchange to trade on.

From there it is as simple as getting verified with the exchange and funding your account (a process that can take a few days).

Once you are verified and have your account funded, the only thing left to do is to buy or sell crypto using limit, stop, and/or market orders.

How to Trade Crypto

To trade crypto:

- Sign up for a cryptocurrency exchange. For example Coinbase or Binance.

- Fund your account. Payment options differ by the exchange.

- Start trading. You can trade dollars to crypto or crypto to crypto.

If you want to trade cryptocurrency you need:

- Dollars or crypto to fund your account.

- A cryptocurrency exchange (or two) to trade on. For example Coinbase, Bittrex, or Binance.

When trading, you can:

- Trade dollars to crypto (for example US dollars to Bitcoin, or Litecoin to US dollars).

- Trade crypto to crypto (for example Bitcoin to Ethereum, or Ethereum to Litecoin).

Lastly, for storing crypto you need:

- A cryptocurrency wallet (or two). For example, Atomic Wallet, MetaMask, Trezor, or even the wallets offered on exchanges.

- A way to secure it. Please brush up on best practices for securing your crypto account.

Get $5 in Bitcoin When You Sign up For Coinbase: Get $5 free Bitcoin at Coinbase just for signing up https://coinbase-consumer.sjv.io/b3b0gk.

Save 10% on Binance Trading Fees: Use our referral link to sign up for Binance and save 10% on trading fees for life: https://www.binance.com/en/register?ref=IX44CLLS. You can also save even more by holding BNB.

Trade crypto commission-free and get free stock at Robinhood: Trade crypto with zero commission and get a free stock with the following referral link https://robinhood.c3me6x.net/BX0ROx.

Trading fee Discounts and Other Signup Bonuses: See a full list of promotional deals for most major crypto exchanges.

Coinbase and Other Crypto Exchanges

One solution for all the above is Coinbase/Coinbase Pro.

Coinbase is a good choice because it acts as a wallet, exchange, and place to trade dollars for crypto and crypto to crypto. In other words, Coinbase is an all-in-one solution for everything noted above!

With that said, Coinbase has a limited amount of “altcoins” (Bitcoin alternatives like Ethereum, Ripple, and Litecoin), and thus many traders also use popular crypto-to-crypto focused exchanges like Binance, Bittrex, and Kraken to access a wider array of crypto assets.

To get access to a wider range of coins, a trader or investor may use more than one exchange, doing something like buying Bitcoin on Coinbase using USD, and then sending their Bitcoin to Binance to trade Bitcoin for other cryptos (converting back to Bitcoin to sell on Coinbase when they are done).

Decentralized Trading: If you want to get into DeFi and decentralized trading, you’ll take a slightly different route. For example with Ethereum, you’ll want to buy ETH on Coinbase or another exchange and then use a web3 wallet like MetaMask for your wallet and a decentralized “DEX” exchange like Uniswap for your exchange to start. Watch out for transaction fees though! Gas prices can be expensive. The process is fairly similar for other networks like Binance Smart Chain.

Cash App, PayPal, and Other Solutions For Trading Cryptocurrency

Of course, not every trader/investor is going to want to or be able to deal with traditional crypto exchanges. Luckily there are some indirect options as well. These include:

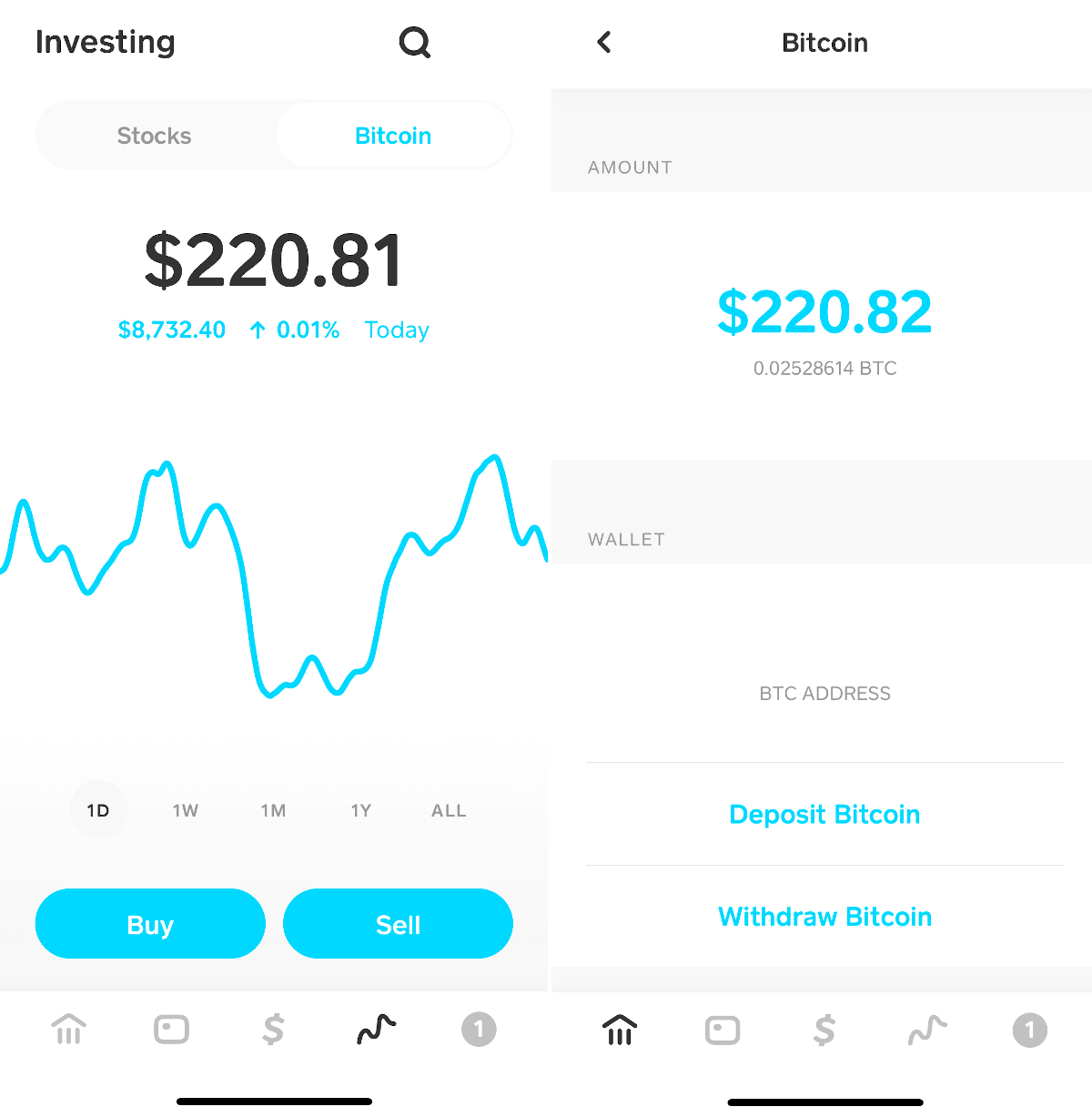

- An app like Square’s Cash App, PayPal, or Robinhood (TIP: For those who don’t want to go the Coinbase route, Square’s Cash App is a particularly good starting point for newcomers who just want to buy/sell Bitcoin and otherwise keep things simple).

- The GBTC trust, ETHE trust, ETCG trust, or another Grayscale Trust as sold on the stock market (these are solid choices, but watch out for the “premium“).

- A cryptocurrency IRA (these have drawbacks like fees, but they can be valid choices for long-term investing).

- A stock that is related to cryptocurrency such as Square, MicroStrategy, Bakkt, or Coinbase (these offer indirect exposure to cryptocurrency).

FTX, Bakkt, and Solutions for Seasoned Traders New to Crypto

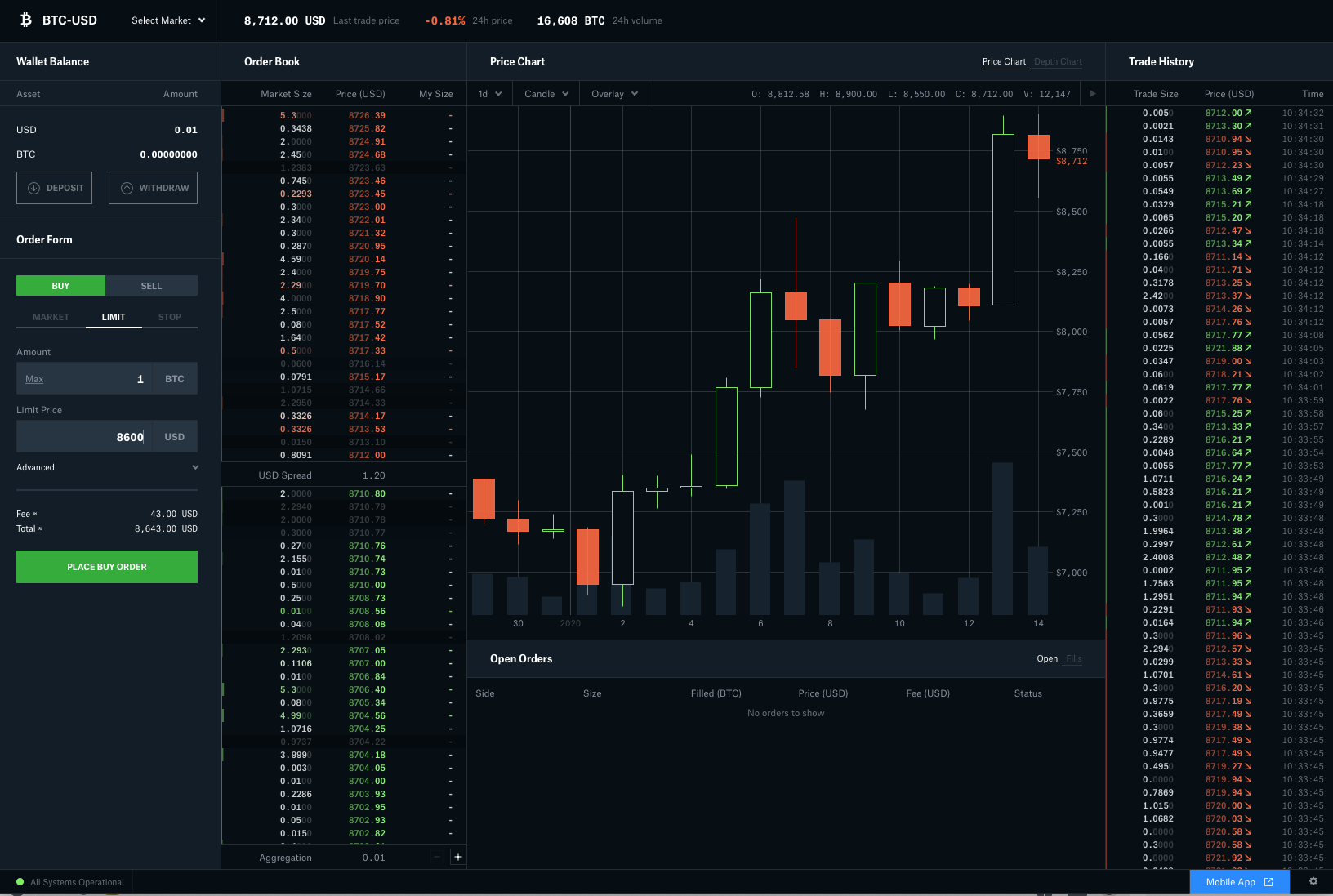

Some traders are going to be familiar with more technical types of trading and/or won’t be US-based. These traders may want to try using leverage, for example on Coinbase Pro or Kraken, or may even consider crypto “derivatives” like futures and options offered by platforms like Bakkt, CME, FTX, or BitMEX. Leverage and derivatives aren’t beginner-friendly, but for seasoned traders new to crypto, they can make sense.

Each option has its pros and cons, but notably, only an exchange-broker-wallet hybrid like Coinbase/Coinbase Pro allows one to trade, invest, store, send, and receive coins directly using a single platform.

Given the above, this page will focus on getting you started with Coinbase due to its ease of use for beginners and its usefulness for advanced users too.

Our Suggestion on where to trade crypto for a newcomer: Use Cash App if you want to keep things simple and just buy Bitcoin, use PayPal or Robinhood if you want a wider but limited selection, use Coinbase if you are ready for real cryptocurrency investing and trading, and lastly once you have mastered Coinbase move onto Coinbase Pro, Binance, and Bittrex to get a wider selection of crypto assets. From there maybe you’ll want to check out Uniswap and dive fully into the world of crypto, but for now the aforementioned is enough to start. Later down the road, if feel like you have mastered trading and risk management strategies, then you may want to consider leverage and derivatives trading, but there is no reason to start there. Trying to do this out of order can lead to real issues, so we strongly suggest learning to walk before you run here. Lastly, at any point in this process, we suggest getting a hardware wallet like Trezor and storing your long-term holdings in your own wallet. Also, once you learn the ropes, educating yourself on other aspects of crypto like mining and how blockchain and smart contracts work is a good idea too!

What You Should Know Before You Start Trading Cryptocurrency

If all you know about crypto trading is the above, you know enough to get started trading cryptocurrency.

However, there are a few things to know about trading cryptocurrency beyond what was noted above that can help you go into crypto trading prepared:

- Trading on an exchange means you need to understand order types. Unless you are using a broker service like Cash App or Coinbase.com, you are going to have to understand the difference between a limit order and market order. And, on some exchanges, you’ll also need to understand how stops work. If you are trading on an exchange, also make sure you brush up on the concept of slippage. Crypto markets can lack “liquidity,” so please be very careful placing big market orders! Learn more about order types.

- Securing your accounts is really important. In crypto if your account gets hacked, or if you lose access to your wallet, you lose everything. There is no way to recover in many situations, so security is super important. A strong password, 2FA, and other good practices are a must. For exchange protection, I suggest 2fa on a Coinbase account with whitelisting turned on in Coinbase Pro (this would force a hacker to not only get past your 2fa, but to spend time turning your whitelisting off to steal your coins). For wallet protection, you MUST write copy your seed/pin/etc onto a device kept offline, best to have a backup and to have them both encrypted (but make sure not to lose that password either). Lastly, secure password programs like Last Pass help. Learn more about securing your crypto accounts.

- The cryptocurrency market is insanely volatile, but TA Can Help. You can make a fortune in a moment and lose it in the next whether you trade Bitcoin, another coin, or even a stock like the GBTC Bitcoin Trust. Consider mitigating risks, hedging, learning some TA (support and resistance and trend trading are good things to learn about for example), and not “going long” with all your investable funds. TIP: If you trade only the top coins by market cap (that is coins like Bitcoin and Ethereum), or GBTC, then the chances of losing everything overnight are slim (not impossible, but slim). Other cryptocurrencies are riskier (but can offer quick gains on a good day). In general, coins with lower market caps and volumes tend to offer a greater risk/reward.

- Trading on margin doesn’t make sense for newcomers. Newcomers likely want to stick to major coins with good liquidity and avoid margin trading. No better way to blow up your account than to leverage altcoins, but some who dive deep into crypto culture will come along the temptation quickly. Common sense says don’t do this out of the gate, so here is your warning!

- Derivatives have their own rule sets. You can’t just HODL an options contract because you’ve mistimed the market, and holding a perpetual long or short contract can cost money in fees. The chance to maximize gains can be attractive, but the risk you take and skill you need make derivatives ill-suited for beginners.

- Cryptocurrency trading is a taxable event. If you don’t understand the tax implications of trading cryptocurrency tread very carefully. There are some nasty traps you could fall into when trading coins. For one, they are not necessarily considered “like-kind assets.” If that is confusing, then consider sticking with trading USD for coins in Coinbase until you grasp the concept. Learn about cryptocurrency and taxes.

- A cryptocurrency exchange is not part of the regular stock exchange. Below we will suggest using an exchange/broker Coinbase, but you can also use the related Coinbase Pro (the pro version of Coinbase with lower fees) once you sign up for a Coinbase account. Neither of these is the same as Wall Street and its exchanges (same general mechanics, different specifics, and different entities).

In other words, if you understand order types, security, and what you are trading, you are ready to start trading.

NOTE: For more tips and tricks, check out our crypto investing tips and tricks page.

TIP: There are a few sides to cryptocurrency. 1. you can trade and invest in it, 2. you can use it for transactions (anywhere a coin type is accepted), 3. you can break out a graphics processing unit and some software and mine coins (see how to mine coins), 4. you can develop for it, etc. All those and more are valid and interesting ways to interact with the crypto space, but with that in mind, this page is focused on “trading” cryptocurrency (and therefore also investing in it). With that said, even if you want to do the other things with cryptocurrencies, you still need to be set up for trading (as for example most miners will sell at least some of the coins they mine and developers will need to fund their operations).

On cryptocurrency mining: As noted, one way to invest in cryptocurrency is via cryptocurrency mining. That is a valid way to start investing if say you love computer gaming and need a new rig and want to invest in small amounts of cryptocurrency while maybe making back some of the cost of the rig (and maybe even breaking even) but that is an entirely different subject. The average investor will want to trade USD for cryptocurrency on an exchange and avoid the complexities and investments of mining. In all cases, unless you already have a good rig with a great graphics card, you’ll need to put down USD upfront anyway.

How to Pick the Right Exchange

Above we laid out some choices for where to trade, below we will dive a little deeper into those choices to help you pick the right crypto exchange for you.

The first thing to understand is that you don’t have to jump right into traditional crypto exchange trading to get exposure to crypto. In fact:

- A beginner might prefer to use the Square Cash App or Robinhood. Square’s Cash App is an excellent choice for newcomers. Cash App lets you buy/sell/send/receive/store Bitcoin just like Coinbase. Cash App doesn’t offer all the other crypto choices Coinbase does, but it does provide a simple way to get exposure to Bitcoin without having to fully learn too much about crypto wallets and exchanges. Meanwhile, Robinhood is another solution that isn’t a full-fledged exchange. While they aren’t offered in all states and unlike Cash App don’t allow deposits and withdrawals, they do offer a larger selection of coins than Cash App and plan to allow transfers in the future.

- A beginner might prefer to trade cryptocurrency stocks on the stock market. For example, GBTC is a trust that owns Bitcoin and sells shares of it. Trading GBTC avoids you having to trade cryptocurrency directly, but still allows you exposure to Bitcoin. Beyond GBTC (and the Ethereum ETHE and Ethereum Classic version ETCG), your options are very limited for crypto stocks. Be aware that GBTC often trades at a premium (meaning bitcoins are cheaper than buying shares of the GBTC trust), which isn’t ideal. Also, cryptocurrency trading is a 24-hour market, where the traditional stock market is not. Learn more about the GBTC Bitcoin Trust and the related pros and cons before you invest.

For those who want the real cryptocurrency experience, the questions become 1. do you want to deal with limit orders and real exchange trading, and 2. do you want a wide selection of coins?

I think the simplest and best place to buy, sell, and store coins in the US is Coinbase (and our tutorial below will help you get set up with that), but you can only buy, sell, and store Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and a small (but growing) selection of other coins on Coinbase. Coinbase will let you try out simple broker-based trading and real exchange-based trading and will give you exposure to enough coins to get you started.

However, if you are serious about trading cryptocurrency, and want access to all the coins crypto has to offer, you’ll want to also sign up for another platform that allows you to buy/sell crypto like Coinbase Wallet, Bittrex, Binance, or Kraken (and may want to find other solutions for wallets to store your coins in like TREZOR).

See our list of exchanges for beginners for a more complete list of options.

TIP: Even if you are going to get fancy with wallets and exchanges, Coinbase is a good starting point because it works as a simple on-ramp/off-ramp for fiat (i.e. you can easily trade dollars for cryptos on Coinbase, and this is not true of most exchanges).

Why Pick Coinbase As Your First Exchange?

As you can tell already, even though we have presented a range of choices, this guide is suggesting that Coinbase is a good starting place. That is because in general when picking a first exchange the following is true:

- A beginner should start by choosing a company with a good reputation that offers an exchange and wallet (to help keep the process simple).

- A beginner should also start by trading prominent coins. Currently, in 2020, we are referring to coins like Bitcoin (BTC) and Ethereum (ETH). In the future, this could change.

Since the above is the case, a good start for anyone wishing to trade cryptocurrency is starting with Coinbase.com (the most popular cryptocurrency website in the United States, and a service that offers a single platform for a Bitcoin wallet, Ethereum wallet, Litecoin wallet, Bitcoin Cash wallet, etc and a currency exchange).

After you master Coinbase, then you are ready for say Coinbase Pro and other exchanges like Bittrex, Binance, or Kraken. After that, you might want to check out derivatives trading if your region allows it and you really have some trading chops. For now though, let’s learn to walk before we run and get Coinbase set up. The next section will walk you through setting up Coinbase.

TIP: A good first foray into cryptocurrency investing is the obvious, buying a major cryptocurrency like Bitcoin. After that, you’ll probably want to trade USD for crypto on an exchange like Coinbase Pro. Once you have done that, you could try trading BTC and ETH for other cryptocurrencies. Trading “crypto pairs” can be rewarding, but it is more complex and often more risky than just buying a single cryptocurrency as an investment. In other words, start by trading dollars for major coins like BTC and ETH on an exchange like Coinbase, and then when you are ready try trading BTC and ETH for other coins on an exchange like Binance or Coinbase Pro.

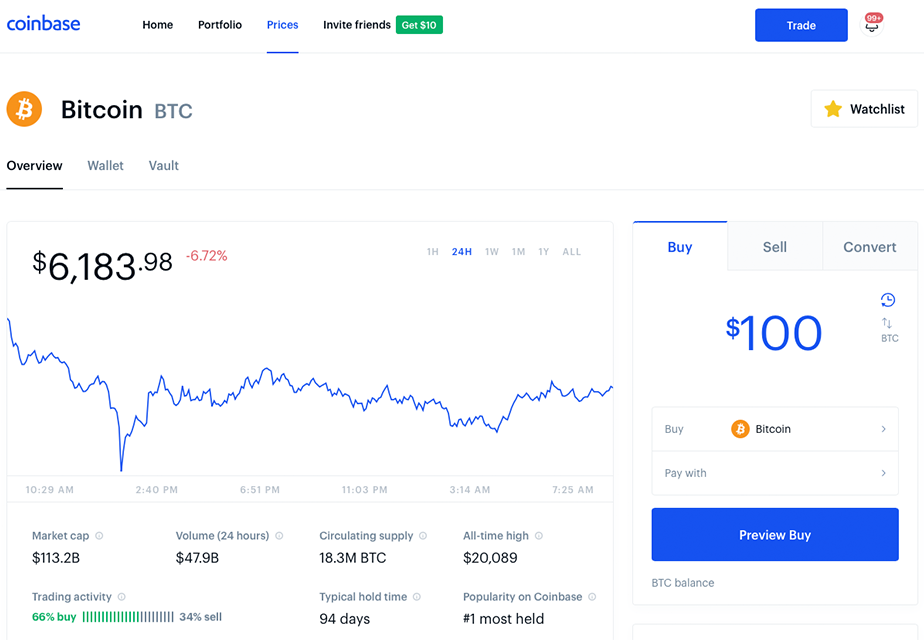

An example of trading on Coinbase. Fees are lowering on proper exchanges than they are with brokers like Cash App and Coinbase Consumer.

TIP: A cryptocurrency wallet is a place where you store encrypted passwords that represent the ownership of coins (roughly the equivalent to storing money in a bank account). A cryptocurrency exchange is like a stock exchange or like a currency exchange in a foreign airport (a place people can trade cryptocurrency for other cryptocurrencies and fiat currencies like the US dollar). Just like if you want to trade stocks you need a bank account and access to the stock exchange, it is the same deal with cryptocurrency. To trade cryptocurrency, you need a wallet and a cryptocurrency exchange.

How to Get Started Trading Cryptocurrency With Coinbase.com

Below we will walk you through signing up for Coinbase. This process is very similar to the signup process for any exchange. The process requires you to trust sensitive information to a third party, and this is yet another reason why we are going with one of the more trusted exchanges out there, Coinbase.

First, to sign up for coinbase.com.

- Sign up for Coinbase.com to create a digital currency wallet where you can securely store digital currency. NOTE: By using the following link you’ll get $5 free Bitcoin when you sign up for Coinbase coinbase-consumer.sjv.io/b3b0gk.

- Connect your bank account, debit card, and/or credit card so that you can exchange digital currency into and out of your local currency (you’ll probably also want to add optional info and upload your ID to expand your purchasing limit).

After you are signed up, you can then:

- Buy Bitcoin, Ethereum, Bitcoin Cash, Litecoin, etc (trading dollars for cryptocurrency).

- Sell Bitcoin, Ethereum, Bitcoin Cash, Litecoin, etc (trading cryptocurrency for dollars).

- Trade Cryptocurrency to Cryptocurrency (trading one crypto to another). You can use the convert button on Coinbase or use Coinbase Pro for this.

NOTE: If you want to use Coinbase Pro, fund your account with dollars or USDC and then move your funds over to Coinbase Pro to trade.

TIP: Coinbase accepts some non-US currencies as payment, but options may be limited. See Payment Methods on Coinbase.com for more information.

TIP: Coinbase is constantly expanding its offerings, check out a list of what cryptos Coinbase plans to offer.

Important notes for buying, selling, storing, and sending cryptocurrency using Coinbase:

- FIRST AND FOREMOST: USE TWO FACTOR AUTHENTICATION AND A STRONG PASSWORD. MAKE SURE TO ENABLE ALL SECURITY FEATURES IN COINBASE. Coinbase/Coinbase Pro is insured, but not against your account getting hacked, just against something happening on their side.

- To increase your buying/selling limits, input all forms of payment possible. Please note, only some banks are supported. Yours might not be. Please note that fees are lower with a bank account, and fees are rather high without one. Given that, you should use your bank account to purchase cryptocurrency directly via Coinbase over other payment methods whenever possible.

- When you sign in with your bank account, you’ll need to input your bank account login. That may feel shady, but is the process (read about it at Coinbase).

- If you use your bank account, you have to wait 3-5 days for your bank to approve the pairing (so you can’t trade for about a week after you sign up).

- There are limits to how much you can buy or sell in a week. Adding a photo ID and other payment methods will increase your limits. Otherwise your limits increase (quickly) over time as you trade.

- Coinbase now has instant purchase when you buy with your bank account. CAVEAT: Not all Coinbase accounts have an instant purchase option. Many do at this point, but not all do.

- There are fees involved with buying from Coinbase and some types of trading on Coinbase Pro (which can in cases get lower as you buy / trade more). Other exchanges have better rates than Coinbase (for example Coinbase Pro itself has better rates). However, rarely do exchanges have a better fee schedule than Coinbase Pro. In other words, when using Coinbase specifically, you’ll pay a little bit more than market price (or sell for a bit less than market price) and pay a small fee when trading on Coinbase (this is a trade-off for ease of use). NOTES: To be clear, there are essentially two sets of fees when you buy with Coinbase. One is them charging you more per coin than on Coinbase Pro or other exchanges; the other is an actual fee (currently paid in crypto, not USD, so if you buy 1 Ether, you get a little less than 1 Ether but pay the market price). That is the price you pay for them doing all the work and taking the risk of the price changing quickly when you buy. Not a reason not to use Coinbase and only use Coinbase Pro every time, but it is something to keep in the back of your mind if you start making lots of buys.

- Today you can use USDC (a stable coin) in place of the dollar on Coinbase in some instances.

- To trade coins, you need to go into settings and make sure your wallets are set up (each coin has a wallet; wallets can be found under “accounts”).

- The benefit of a USD wallet on Coinbase is that you can put money in that and then, once the deposit clears, use it to buy coins immediately moving forward. If you try to buy directly with your bank account, the transaction can take about a week. Given this, it is smart to fund your USD wallet or buy USDC and then use that moving forward to buy crypto. You’ll still need to wait for the deposit to clear, but once it is cleared with your bank you can use the funds. You can buy coins on Coinbase.com via your USD wallet (just toggle to USD wallet instead of bank account when making a purchase).

- You don’t have to buy a whole coin. You can buy fractions of coins. Whole Bitcoins can be expensive these days, so consider buying fractions of a coin to start if you don’t have a big bankroll. It has historically been a mistake to buy only other cryptos because BTC costs more. You need to think of which one will increase in and retain value, buying all three in equal $ amounts (and ignoring how many of each coin that amounts to) is one way to avoid making the wrong choice based on price tag per coin.

- When you buy a coin, take a breath and review the information. An extra decimal place can mean big money considering a single Bitcoin can trade for over $4,000.

- Sending cryptocurrency to other users is easy with Coinbase. You can send to the email address of another Coinbase user, or you can send to an outside address. Just make sure to review the information carefully. You can’t reverse a transaction if you send to the wrong crypto address!

- Download the app. This lets you trade cryptocurrency from your phone. The market is volatile; transactions are slow. When it is time to buy or sell, you need to do it ASAP.

- Set alerts. Alerts can help you decide when to buy or sell.

- There is a feature that lets you buy incrementally over time. Averaging in a position on a weekly basis is a solid conservative move that Coinbase will automate for you.

- Cryptocurrency is volatile! There is always the chance that the market will crash, or that you will face some other catastrophe. Cryptocurrency isn’t a centrally controlled and regulated fiat currency. If you lose a coin or someone cheats you, there is nothing you can do about it (which is why you want to have 2-factor authentication set-up).

In other words, trading cryptocurrency is simple to start, but there are some essential aspects to understand before you start trading with a wallet-exchange like Coinbase.

And remember, there are countless other options for setting up wallets and trading currency. Most will, however, pair with a Coinbase account (making it a logical place to start).

NOTE: Once you have Coinbase down, try moving onto Coinbase Pro. It’s, in overly simple terms, like a better version of Coinbase with lower fees. Coinbase operates both platforms, and both use the same logins. Coinbase Pro is the preferred exchange of many Bitcoin traders in the U.S. It caters to both pros and novices. After you master that, then consider exchanges like Bittrex and Binance.

For more, check out our cryptocurrency investing starter kit and some tips on cryptocurrency investing and trading.

Bottom line: Although things can be as simple as grab Coinbase, Binance, and a TREZOR, or just click some buttons on the Cash App, the reality is beginners have a range of choices for how they want to approach crypto! Cool thing is, you can try them all.