Comparing BTC 2014 Bubble to ETH 2018 Bubble

Check out this image comparing the BTC 2013 – 2015 bubble to the ETH 2017 – 2018 bubble. Looks uncanny.

Cryptocurrency opinions, op-eds, speculation, and insights. Oh, my!

Check out this image comparing the BTC 2013 – 2015 bubble to the ETH 2017 – 2018 bubble. Looks uncanny.

Sometimes all the good news in the world isn’t enough. ETH is in a downtrend despite two regulated Ethereum-based stable coins that could be Tether killers being announced and despite ETH futures on the horizon.

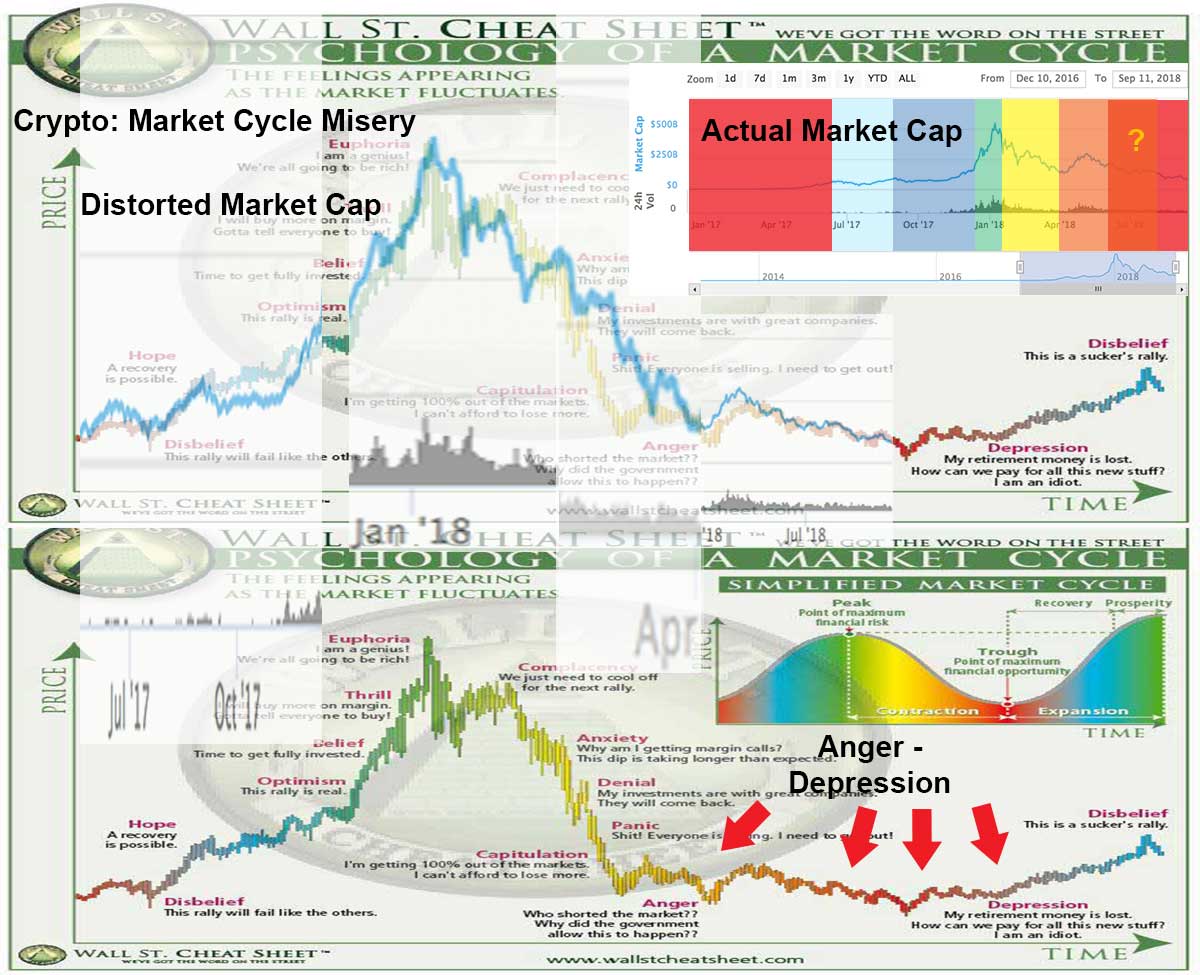

Is this the anger / depression phase of the cryptocurrency market cycle? Let’s take a look at the phases of a market cycle and the chart of the crypto market cap over time to see.

Someone who has zero exposure to cryptocurrency, but knows they want cryptocurrency, might consider building an average position slowly over time, aiming to have a position built by the end of the bear market.

What if Summer 2017 – Fall 2018 was actually a type of correction for ETH, a response to the epic bull run of late 2016 – early 2017? It would fit the pattern of what happened between early 2016 – late 2016.

It looks like Mt. KillYourPortfolio (Bitcoin) could be erupting for a fifth time this year, once again covering the citizens of cryptoland (altcoins) in a sea of red lava (red candles). This natural crypto cycle helps to create fertile lush green mountains (green candles), but that is little consolation to those who haven’t sought shelter (HODLers). <—— because altcoins tend to correct harder than bitcoin when bitcoin goes down and sometimes they fail to go up with bitcoin, bitcoin forming little mountains “kills your altcoin portfolio.”

The ETCG premium is at its lowest point ever, meanwhile the GBTC premium is near its 2018 low (it was lower in February for a day).

Ethereum is stuck under $300 at 2017 prices and losing value against Bitcoin and most alts here in early Sept 2018. Thus it begs the question, “is Ethereum Dead?”

In my opinion the wash sale rule for securities should be applied to cryptocurrency trading. This rule would help smaller investors avoid potential traps, and would keep those with more money from exploiting loopholes.

The average crypto trader who traded crypto with any frequency is likely to fail at properly reporting their crypto profits and losses because the task of calculating everything is overly complex. For the IRS to fine the trader, they will have to tally their profits and losses. If the IRS has software that does this…. they should share it.

By continuing to use the site, you agree to the use of cookies. more information

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.